Market Outlook: Properties and Oil & Gas | Technical Analysis | Singapore Stocks

New: Join our 3-hour live workshop with Spencer to learn the basics of trading and make your first live trade!

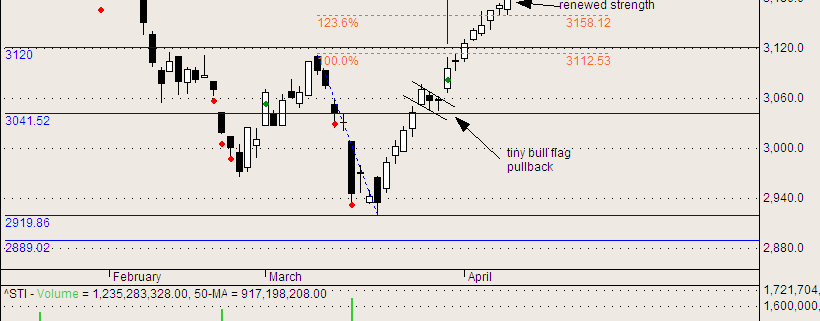

Looking at the STI, it has certainly started off April strongly (refer to the last post), without even pausing to take a breath from the long run-up. Unfortunately, contrary to what I thought, there was no good pullback for entry. In fact, last Friday closed on renewed strength. There are 2 possible resistance zones ahead which could pause the current move, namely around 3305 and 3220.

Please take some time to answer this poll: “Are you feeling bullish or bearish about the Singapore stock market?” (click here to answer and view poll results)

Looking at the daily chart of CapitaLand, we can see that there is an inverse head-and-shoulders formation, which is a bullish reversal pattern. It has broken the neckline on a bullish gap up, and has now broke through the previous resistance at 3.46. It looks poised to head higher, with possible resistance near the top of the downwards sloping channel.

Looking at the daily chart of Keppel Corp, we can see that it has recently broke out of a triangle pattern, and has now formed a bullish flag/pennant pattern. Volume is on the decline and bars are small. I would enter with a tight stop to wait for a strong breakout, with a potential target of 14.00.

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

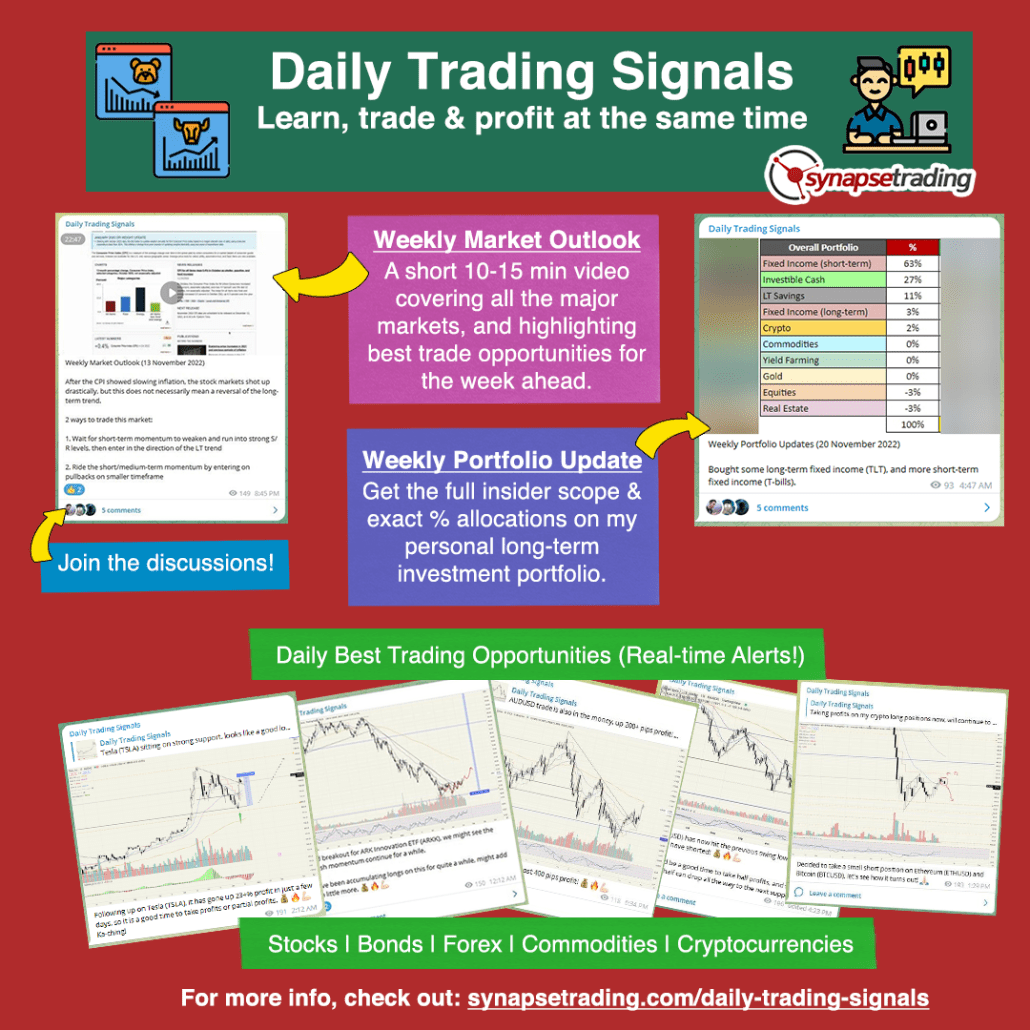

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!