Stock Indices Update: STI and S&P 500

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

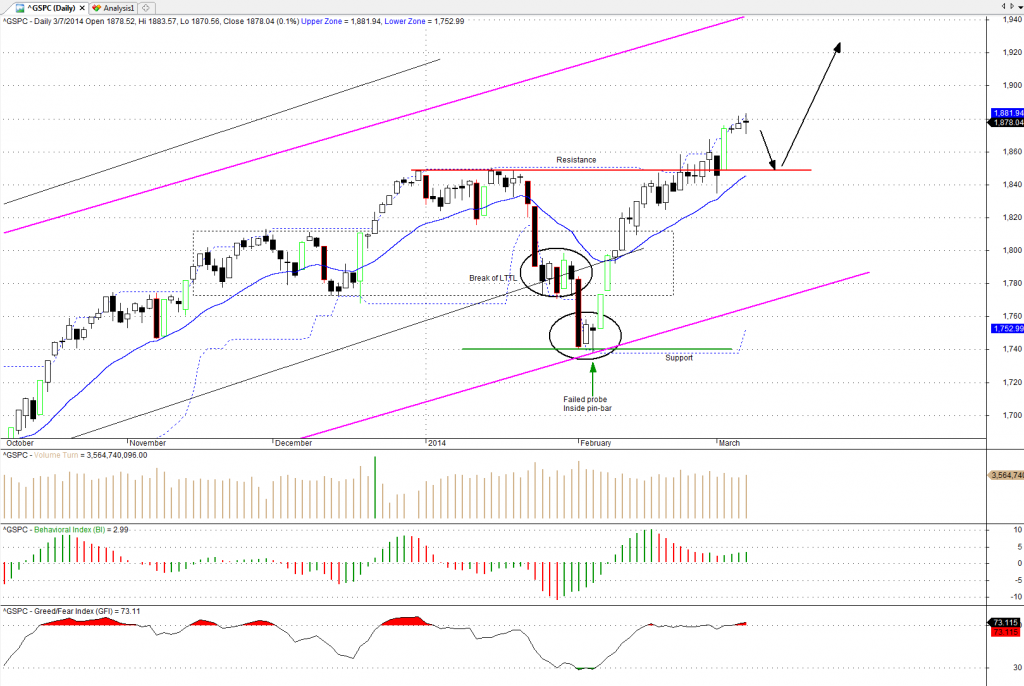

The S&P 500 has broke new highs, and is likely to have a pullback before climbing further. This means that stock investors are still bullish on this market for the medium-term, and traders should not short till there are more signs.

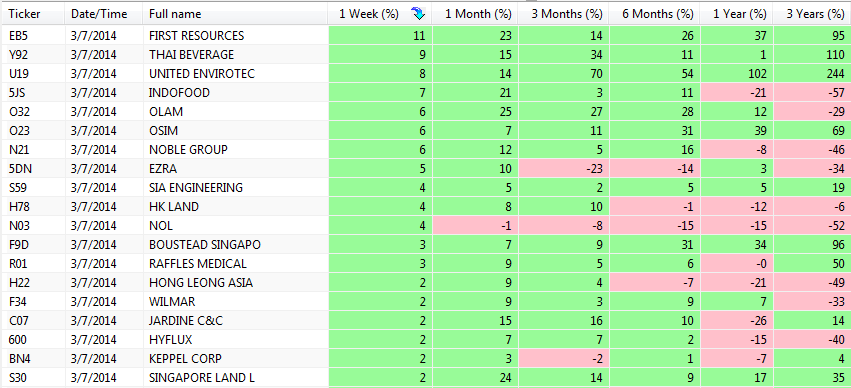

The STI is also pretty strong, exceeding my expectations of a pullback. As a trader, the correct mindset to adopt is that the market is always right, so even if I was expecting it to drop, I must always be prepared for the exact opposite to occur, and act profitably on it.

As mentioned in some previous posts, the commodity counters are extremely strong, and I will continue holding on till I see signs of weakness. My short counters like YZJ and SembMar are still in the money, and I have shifted my SL to breakeven, so I am not too worried even if the STI continues its strong move up.

Looking at the chart below, if the STI clears the selling zone (circled in red), we have to take one step back and see the bigger picture, which is a large rectangular range. If we were to consider the recent breakout as a bullish flag breakout, we could see the STI surging all the way to the 3240 level.

Instead of trying to predict the market, I am ready to trade on both sides. As my mentor used to tell me, “trade what you see, not what you think.” Good luck!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!  If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

Leave a Reply

Want to join the discussion?Feel free to contribute!