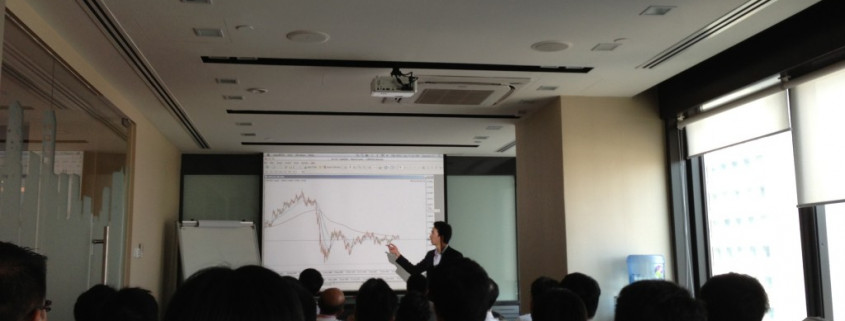

Yesterday, we gave a private seminar for selected clients for CMC clients, and although it was raining heavily, the turn-out of 40+ was pretty decent. We shared about behavioral analysis, psychology and market timing, and gave our outlook and stock picks. Although I didn’t do any selling, a few people signed up for the upcoming March intake for the Synapse Program. For those who didn’t get to attend this seminar, fret not, as I will be organising more that are open to public, perhaps some time in April.

Feedback

“My key takeaway is that there is no easy way to success, and one must be disciplined.”

– Wong Tian Wai

“Good pace, trainer has good knowledge.”

– A.Manickkam (1 year experience)

“Speaker speaks well and is humble. There is a good overview of trading, type of trading and wealth creation.”

– Wee Chung Soon (4 years experience)

“I liked the new ideas. Something different is the 4 major patterns presented differently. It gives me an added dimension of seeing.”

– Leslie Tan (>5 year experience)

“I liked the market outlook best. My key take-away is the 4 different types of behavioral patterns.”

– Anonymous (>5 year experience)

“The website provides lots of useful info. The speaker is very knowledgable.”

– Steven Hong (5 years experience)

“My key takeaway is the free reading list provided.”

– Alwin Lim (manager)

“I learnt to focus on price action and not on indicators. My key takeaways are the different setups and the wealth pyramid.”

– Anonymous (Housewife, 1.5 years experience)

“My key takeaway is that timing is the essence to stock markets.”

– Hailey (Financial Analyst)

“The setups are easy to understand, and one key takeaway is that there is no holy grail in the market.”

– Peter Nwee (Manager, 5 years experience)

“Honest sharing by Spencer. No hard-selling, good and sincere. The pace is good for even beginners.”

– Max Thiam (Engineer, 5 years experience)

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.