This article documents an exclusive interview with Spencer Li by Alvin from Big Fat Purse, another local blogger specializing in financial education. Alvin and Spencer met when Alvin attended one of our seminars by Spencer on trading, which later transpired into this insightful interview. Enjoy! 🙂

This article documents an exclusive interview with Spencer Li by Alvin from Big Fat Purse, another local blogger specializing in financial education. Alvin and Spencer met when Alvin attended one of our seminars by Spencer on trading, which later transpired into this insightful interview. Enjoy! 🙂

How did you get into trading?

I came from a humble family background, where both my parents knew little about investing or trading. Having worked multiple jobs prior and during my studies to cover my tuition fees and expenses, I knew that I did not want to spend the rest of my life struggling in the Rat Race to make ends meet. I heard that the financial markets offered great opportunities, but also housed many pitfalls. Through my own research on behavioral science, I realized that many of these pitfalls were psychological in nature, and I knew that I could develop a methodology to overcome them and gain a profitable edge. Thankfully, I was right on both counts.

How did you learn to trade?

I was a bit of a perfectionist, so when I first started, my goal was to learn all there currently was about trading and investing, and to do this I gathered all the top books on trading and investing (over 200 of them). I ploughed through all of them within 2 years, picking them apart to see what worked and what didn’t. Next, I moved on to create my own strategies, testing them on demo and live accounts. Later on, I further honed these strategies through large-scale practical application when I progressed to trading for proprietary and private equity funds.

There are other avenues to make money other trading the financial markets. Why do you choose the latter? It must be more than just money, passion perhaps?

To me, the financial markets are one of the fastest and easiest ways to make money, if you know how to. And unlike other ways of making money, this does not require a lot of time or capital. Of course, I also love the challenge of the markets. I used to be a competitive chess player, and to me the market is like a big game, and once you learn the rules, you can keep playing and improving.

Being a former competitive chess player, what has it taught you about trading?

Chess has played a pivotal role in helping me develop my proprietary trading technique of behavioral analysis. In a game of competitive chess, the real game is outside the chess board. To win, you have to decipher your opponent’s behavior and thought process to anticipate his movements. Similarly, the market is just like another giant chessboard, where we use charts to decipher the behaviors and actions of other players. In this case, besides the fun and the challenge, it can also be very financially rewarding.

What do you trade?

My portfolio is divided into 3 parts:

1. Buffer assets (cash, unit trusts, insurance, CPF)

2. Investment portfolio for passive income

3. Trading portfolio of CFDs (Singapore stocks) and forex

Can you briefly describe your trading strategy?

To start, let me first explain the philosophy behind my strategies.

Most trading strategies fail because of 3 reasons:

1. Low hit rate with too high risk

2. Too complex to execute

3. Too time-consuming

To solve these problems, I utilized behavioral science to study the behavior of markets and individuals, finding universal traits that enabled me to effectively time any market with minimal risk. By keeping the setups simple and effective, only 30 minutes a day is required for analysis and execution. For example, by using the principle of “one good trade a week”, it is good enough to replace the income from most typical “9-to-5” day jobs. By focusing only on quality setups, there is no need for constant monitoring, and thus pretty stress-free.

Can you share with us a recent trade which you have made, to illustrate your decision making process?

For example, recently there was a strong price surge in SMRT, and there was no major news prior to the move. Since the stock has been on a prolonged decline for the past few years, big players would be looking for a chance to buy. Looking at the unusual high volume, it is a strong clue of hidden buying, and also a strong signal for me to start buying as well. I have documented the trade in this article.

Why do you want to teach trading?

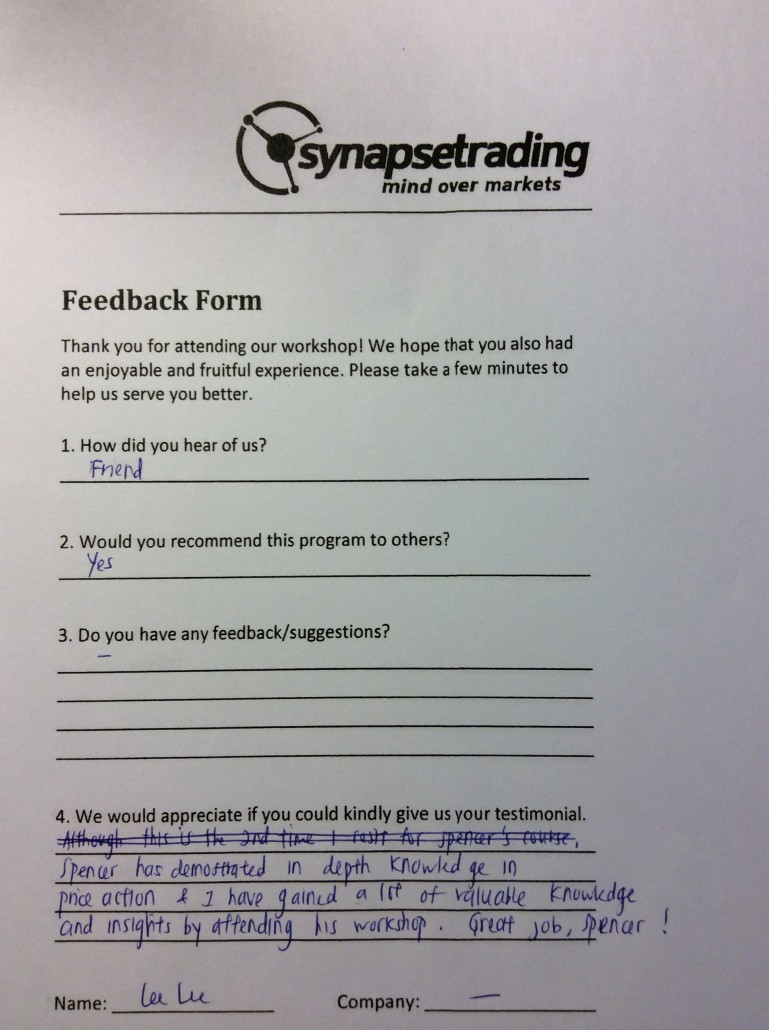

When I first started a blog to record my trades many years back, the thought of teaching never crossed my mind. In fact, I had to reject quite a number of requests from my readers to teach and share my skills. However, when my closer friends started asking for investment advice and “insisted” that I teach them, I did a couple of informal sessions, and when the group started to grow, I realized that it would be better to have a proper course syllabus and an on-going training program. It took me another 3 years of blood and sweat before the full “Synapse Program” training was completed. As of today, I am glad to have helped many individuals break free of the Rat Race and start a new life.

Are there common traits among your successful students?

In the final segment of the “Synapse Program”, we have this module called “The 7 traits of all successful traders.” Basically, it is a compilation (from new and professional traders) of the essential mental attributes that a trader needs to acquire.

Of the 7, one of the most important traits is discipline. Traders who fail generally do so because they get too greedy and deviate from the system, or skip some steps due to laziness, and thus do not get the best trades. Other traits include mental agility, circle of control, knowing when to cut losses, and knowing when to take profit, etc

Once again, a big thanks to Alvin for taking the time to interview me, and hopefully this article has given you a new insight into professional trading and the science of behavioral analysis that professional traders use to profit consistently.

For more articles, interviews and resources on investing and trading, you can visit:

http://www.bigfatpurse.com/

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.