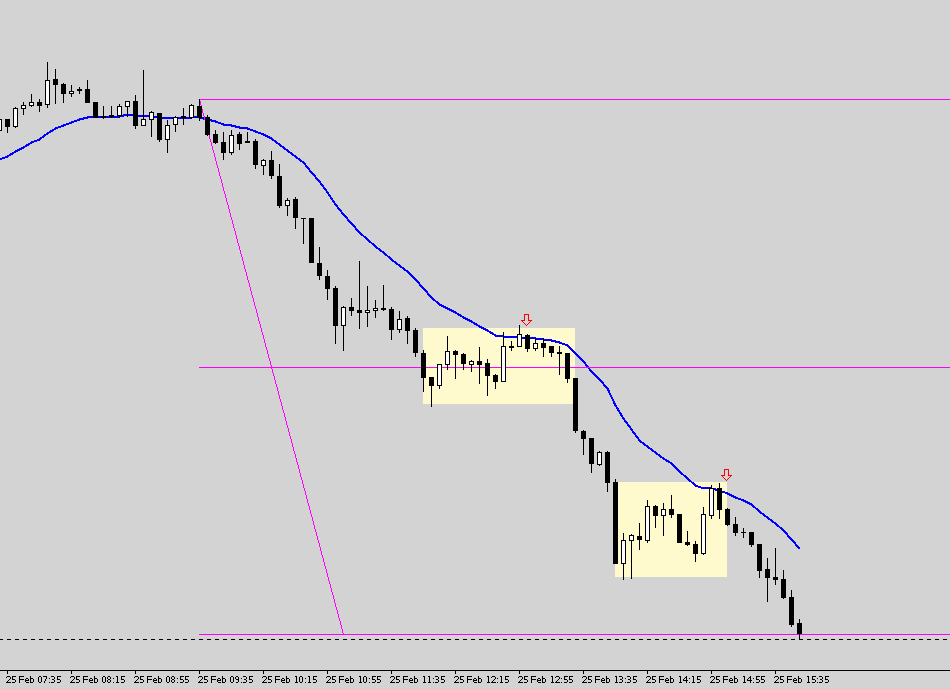

A violation of a major trendline is the first obvious sign of the Turn, which was confirmed by the sharp pullback test after the breakout, forming a long upper shadow and a clearly tell-tale price bar. A rough TP zone would be 1.2650, confluencing with a round number, prior swing support, and a measured move.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.