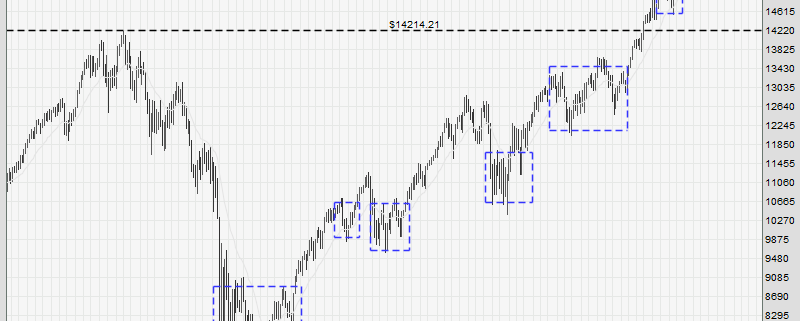

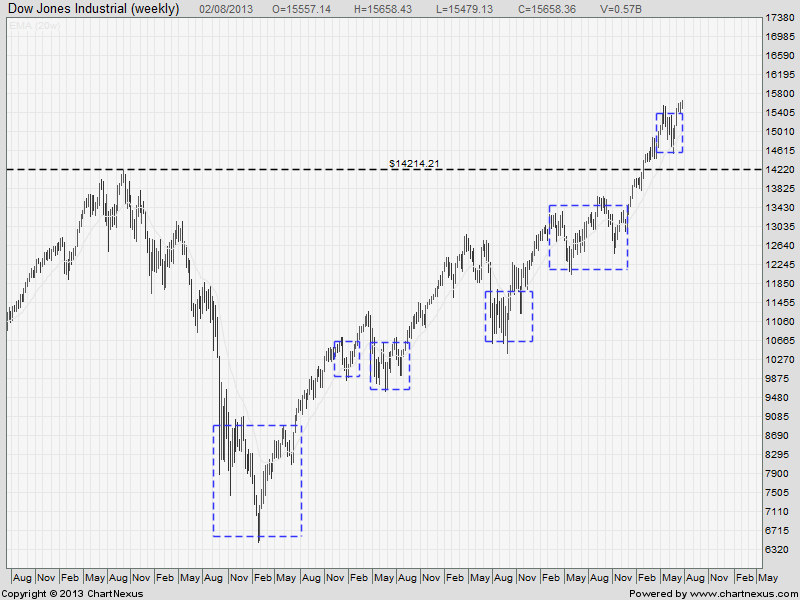

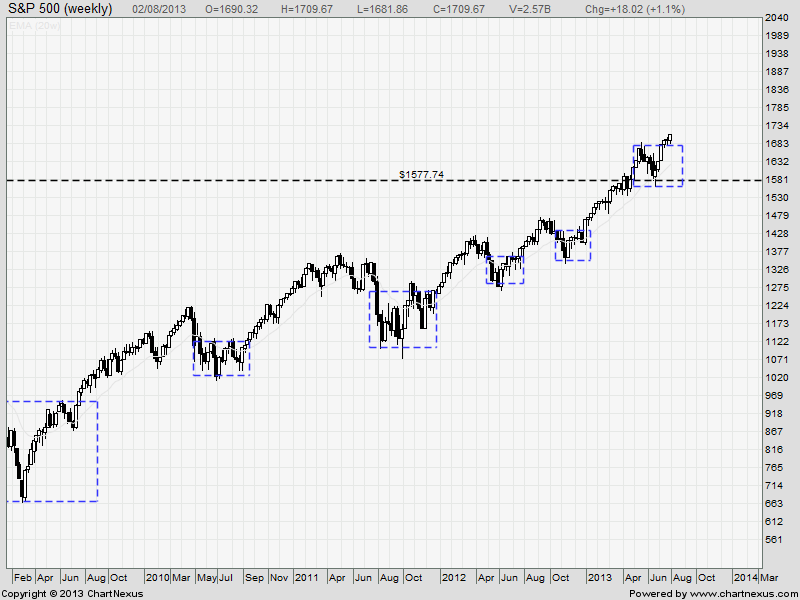

I have chosen 5 weekly charts to provide an overview of the global markets, and to see where we are likely to be heading next. The black horizontal line denotes the 2007 highs, to provide a reference point for comparison. The blue boxes indicate key behavioral clues for us to read and time the markets.

First off, we can see that the US markets are the strongest, surpassing the 2007 highs, and looking poised to push even further.

Next, we move on to the European markets, which have not recovered much. The decline has been plugged, but instead of recovery, all we see is a slow chugging movement elucidated by a prolonged sideways market.

Nearer to home, the China markets have been extremely weak, continuing an aimless drift downwards. It does not look like it would be recovering any time soon.

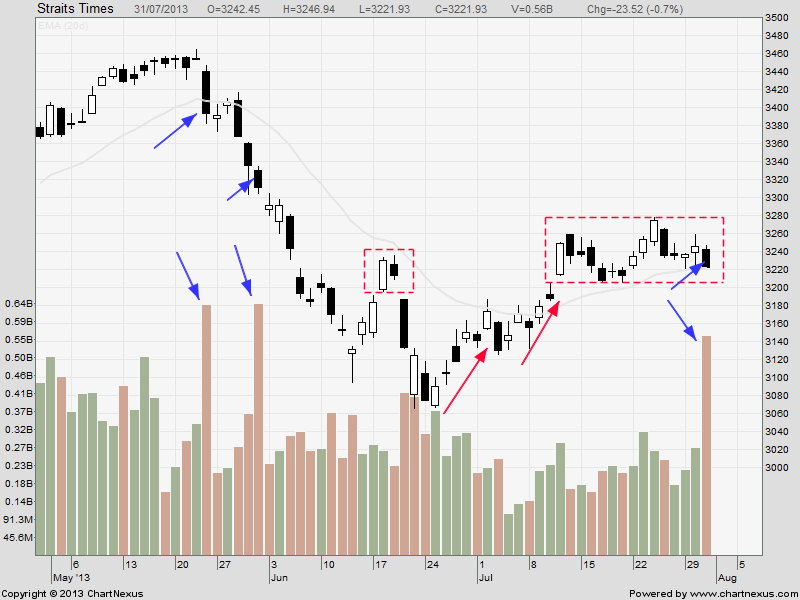

Lastly, this is the chart of the STI, straddling the middle ground between the strong US markets and the weak China/Europe markets. Since we have already recovered by more than 50%, I believe there is a good chance we will make a push to test the 2007 highs.

Currently, I am still holding on to my long positions, which are already deep in the money, and recently initiated some short positions. Here are the previous documented posts:

https://synapsetrading.com/sti-banks-signs-of-cracking/

https://synapsetrading.com/sembmar-a-surreptitious-change-of-hands/

On Tuesday, I will be sharing more at my live event, and you can drop by if you have any questions about the market. Actually, the event is already sold out, but if you don’t mind standing, or taking the chance that some people might not turn up, you can still drop by to avoid missing out on this event.

http://www.eventbrite.sg/event/7582887621?ref=ecal

To get priority updates on our future events, you can sign up for our mailing list,

and also “like” us on facebook.

https://www.facebook.com/synapsetrading

http://forms.aweber.com/form/18/2028118318.htm

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.