Precision market timing refers to making an entry just as the move is about to start. There is nothing magical about it. It simply involves reading the price action and behaviour of the market.

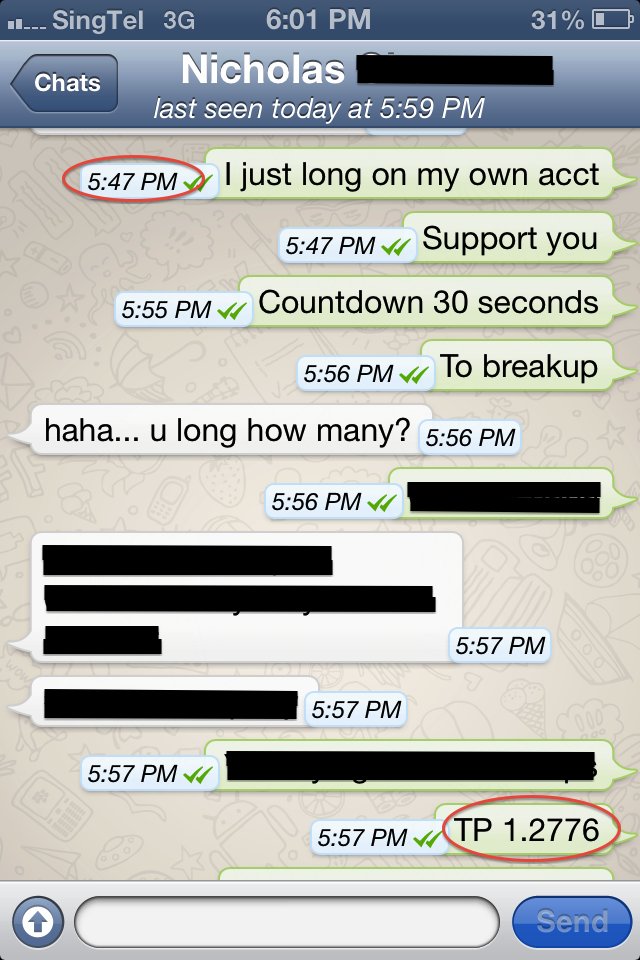

In this case, after I went long at 5.47pm, I knew a breakout was coming soon, and true enough, within 30 seconds, price shot up strongly as shorts took profits and the buyers stepped in.

Since this move was sharp and fast, I already knew where my target exit price was – 1.2776. Although it wasn’t at the exact high, it was close enough for me, as price continued the trend down in the next few bars (not shown).

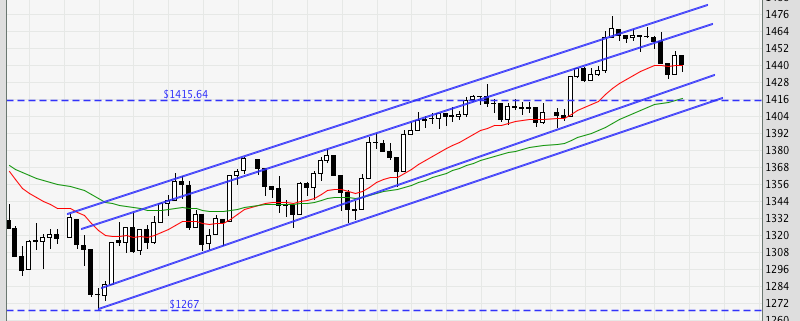

This setup is known as the BIG Bounce, because it involves taking a position against the trend, hence speed is essential.

What is the BIG Bounce about?

When the mark-up and mark-down campaigns are coming to an end, the BIG Boys will deliberately play up market emotions, triggering a strong climatic move to trap unsuspecting greedy or fearful traders, which the BIG Boys use to offload their positions and take profits. This creates a BIG snapback in the opposite direction as trapped traders cut losses and try to get out.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.