Commodities on the rise – Indofood and Noble | Technical Analysis | Singapore Stocks

New: Join our 3-hour live workshop with Spencer to learn the basics of trading and make your first live trade!

Currently, I am long on indofood, and you can see from the chart that it is in a nice uptrend channel with quite some space to its next level of resistance at 2.58. Olam recently exhibited a similar pattern.

Currently, I am long on indofood, and you can see from the chart that it is in a nice uptrend channel with quite some space to its next level of resistance at 2.58. Olam recently exhibited a similar pattern.

Noble seems to be the laggard in the commodities sector, but it has found decent support, also exhibiting a double bottom test, followed by a pullback. This double bottom pullback pattern is very bullish, plus it has just broken out of the price channel.

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

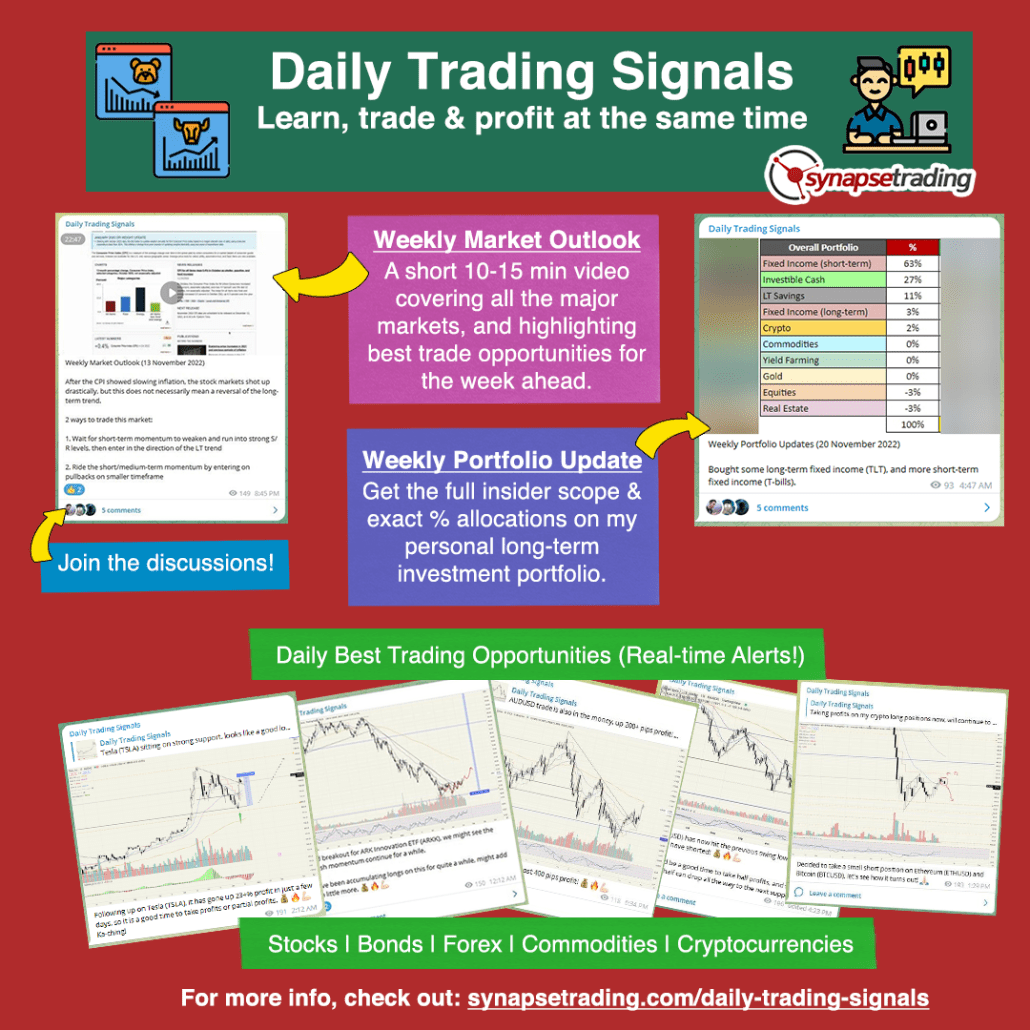

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

HI, i would like to gather some feedback on indofood agri? on it's valuation or intrinsic value. I dunno much about commodities but i see a raise in sugar and oil might boast the shares prices on this counter and golden agri. Just wanna know is the price now at 2.67 overly priced? or there is still a upward potential?

Or is Golden Agri a better investment?

It really depends on what you mean by overpriced. Valuation inputs and subjectivity largely determines the output target price.

Here are some analyst calls:

10/27/2010 Golden Agri 0.68 GS

10/26/2010 Golden Agri 0.78 OCBC

10/22/2010 IndoAgri 3.10 DBS

10/11/2010 IndoAgri 2.64 CIMB

9/22/2010 IndoAgri 2.30 MS

Technically, both look rather good for the long-term, since they are making new highs. Generally, commodities are expected to go up when the USD is low and inflation kicks in.