Bullish Belt Hold

Market AnalysisBullish Counterattack Lines & Bearish Counterattack Lines

Market AnalysisUpside Gap Two Crows

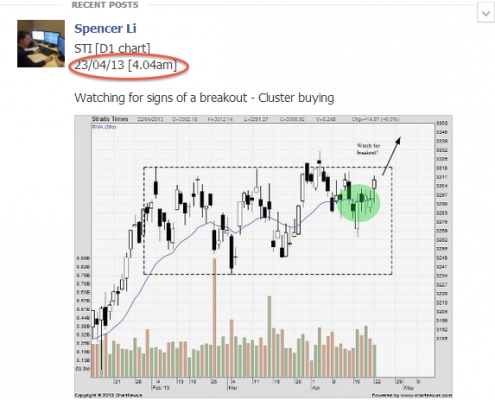

Market Analysis1. Market Analysis

2. Travel Adventures

Nothing Found

Sorry, no posts matched your criteria

3. News & Events

Free Trading Workshop | Market Outlook 2013 – Back by Popular Demand!

After giving the “Market Outlook 2013 Seminar” last week, I got a lot of requests to hold another session as seats were very limited. Those who attended last week will recognise this chart, and kudos who those who acted on what I said in the seminar and bought this stock when it gapped down the […]

Free Trading Workshop | Market Outlook 2013 – The BIG Moves Ahead

Last Saturday, I conducted a market outlook seminar for 2013, sharing how to read charts using behavioral analysis and how to identify the 4 major behavior patterns. This was done on-the-spot using real examples, and without using any indicators or special software. Due to space constraints, we were only able to accomodate 50 people, so I […]

Program Graduates | Traders Network – Private Forum

Email from a new student: I recently received a heart-warming letter from one of my new students, and I thought I’ll share it here. He will be one of the lucky 10 attending the March intake of the Synapse Program, and he has already started reaping the immediate benefits of the private discussion forum, even […]

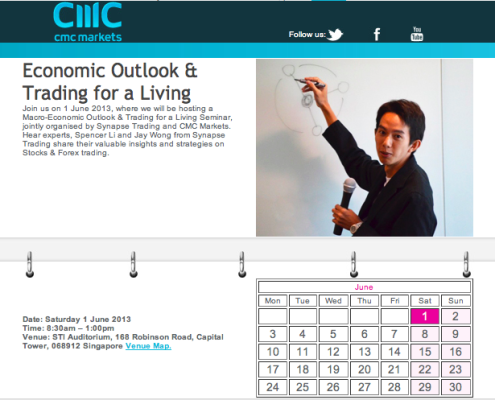

Private Trading Workshop | Real Trading Skills Seminar at CMC Markets

Recently, I conducted a training seminar for CMC clients, sharing how to read charts without using any indicators or special software. I taught them 3 simple techniques – EMAs, Market Phase & Visual Scan – which we later used to do analyse some stocks and indices together. This was a very decent turnout with over […]

Important Announcement: Facebook Policy Changes

We’ve been informed by our fans that Facebook has made some changes to FanPages lately, restricting the visibility of posts made by all FanPages like ours. We are now required to pay for the visibility of posted content, even if you have signed up to see these posts by liking our Page. If a post is […]

Trading Class | The Synapse Program – Another Batch of Promising Traders!

Last weekend, we concluded another full-house run of the Synapse Program, training another batch of promising new traders, and imparting to them lifelong real trading skills, which we hope they will continue to apply to achieve consistent results in the markets. We look forward to seeing all of you participate actively in the discussion forum, […]

4. Life Hacking