The Beginner’s Guide to Trading & Technical Analysis

For newcomers who want to learn how to trade, the large amount of information out there can be overwhelming to digest, which is why I have summarized it all in this compact guide.

In this beginner’s guide, you will learn:

- The key concepts and principles about trading and technical analysis

- How to create a trading plan & strategies with a clear roadmap to profitability

- How to start with paper trading and use a trading journal to track your progress

Thanks for the great content, very useful for beginners, and all in one place!

You’re welcome!

I came from your Tik Tok channel. I must say that I am still absorbing the huge amount of info that you are sharing here. (Thumbs up)

You’re welcome, and thanks for the support!

I must say that you are a good teacher with your unique Asian voice!

You’re welcome, and thanks for the support!

Hi Spencer! Thank you for the in-depth introduction to FOREX. This helped me understand the direction I would like to take as a new trader. I agree with the Trading Journal because by using this I am able to track my progress weekly and ideally avoid committing the same mistakes I made.

You’re welcome! Great to hear that you are off to good start. Yes, keeping a trading journal is important to track your progress, because it provides something for you to look back on and study your past decisions.

Do you have a template of the trading journal that you use?

Not at the moment, because most of my trading records are digitised so I download them directly from the online brokerage platform to do analytics. When I have time, I’ll try to create a sample template which you can use.

It will help that you have a pdf or excel file of it.

I think there are some free ones online. Do consider it.

Personally this is good for me and its free!

https://tradebench.com/free-online-trading-journal/

Thanks for sharing!

Really helpful and insightful guide for me as a beginner. Will share to my friends.

You’re welcome! Do go ahead and share, I am sure many people will benefit from having the foundation knowledge before they start trading!

Love your neat and organized info! Its easier for me to digest.

You’re welcome! Thanks for your feedback!

I feel the same! Organized and neat, with videos and infographics.

Hey Spencer! First of all, thanks for the info here! Only found your website after my friend was sharing about your Telegram Channel!

Do we get to see a sneak peek of how your trading journal looks like?

You’re welcome, thanks for the support! I was actually planning to do a blog post on that soon!

I am also looking forward to your trading journal!

It will be out really soon!

Are you using a generic trading journal or something a bit different in terms of the information that you recorded???

I think most trading journals are pretty generic, because the same data and trade parameters are recorded. The part that is different is how you choose to record your thought process in making the trade.

Should I start trading forex or stocks first?

The product per se doesn’t make a difference, the more important consideration is how well do you know each product, how much capital are you starting out with, and does your lifestyle and time gel with the timing of the markets that you want to trade?

I assume forex is harder than stocks? I read some guides that its easier to deal with stocks first.

I feel that there is not much difference, since both is just buying and selling based on the charts. Main difference is probably the risk management as both products are calculated differently.

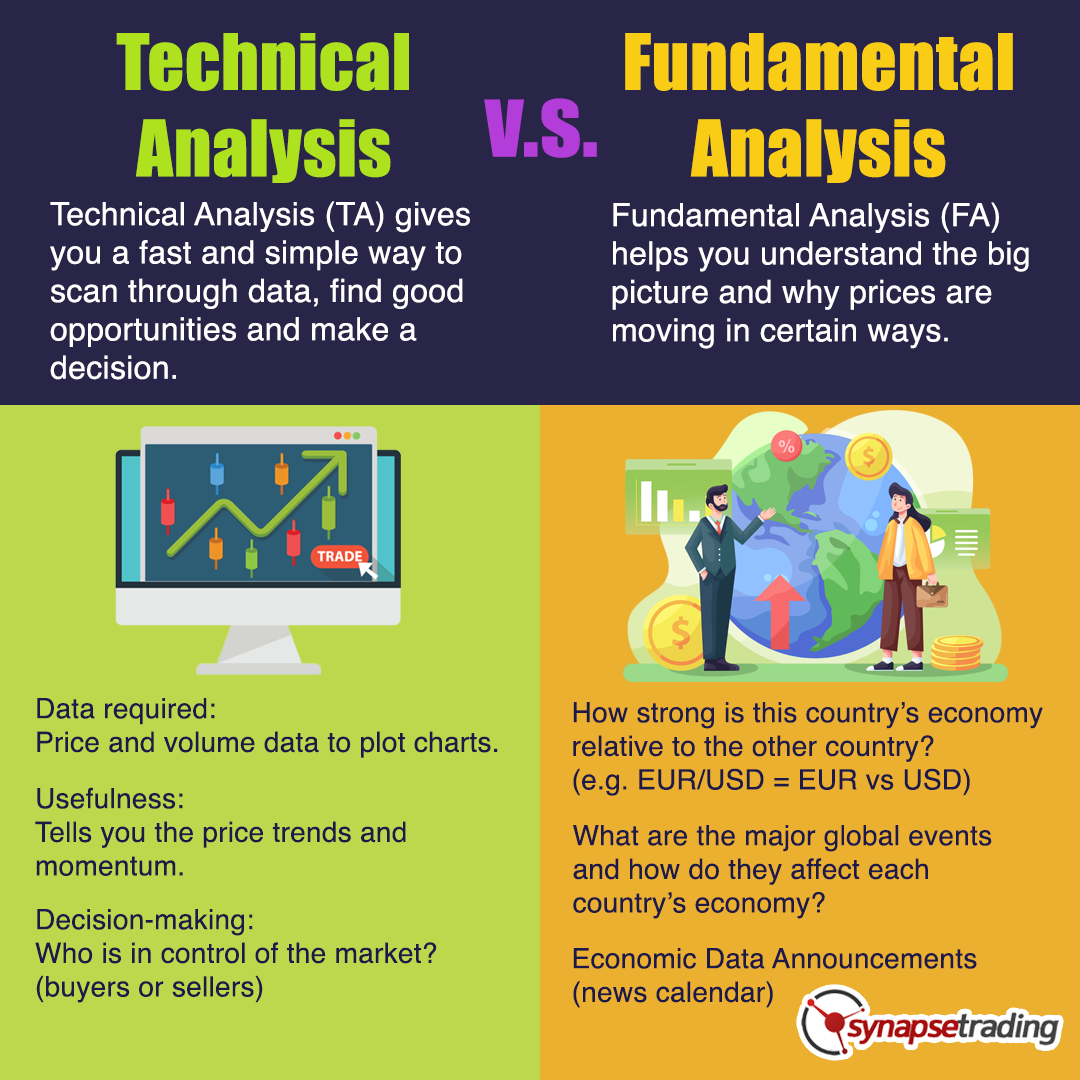

I will say that its easier to go into stocks as you can look into the fundamental analysis of the company instead of a currency pairing. Its easier to look into selected companies instead of combing world news.

Fundamental Analysis is for long term. Technical analysis is for short term.

Actually that’s not really true, because to do fundamental analysis for stocks, you will need in-depth accounting knowledge to analyse financial statements.

Thanks!

Will you be touching on futures or options on your website?

Yes, we are planning to do that in the future! Stay tuned!

Do you feel more stress trading compared to investing? As trading has become a full time job???

Once you have a system in place and you know what you are doing, trading and investing is actually supposed to be boring. That’s why I only spend 15 minutes a day executing my trades.

How much do you make on average a day as a full time day trader?

As a gauge, 5-10% returns a month is consider decent.

I notice you sell signals for traders.

Do you have something for investors? I am usually working during office hours so its hard for me.

I mean you have signals for forex.

Do you have signals for stocks or anything related?

Our signals actually cover a wide range of products, including forex, stock indices, commodities, cryptocurrencies, etc. However it does not cover individual stocks.

Nice! I see there are some new updates in the trading guide!

You’re welcome! We continuously add new content to keep all our guides updated!

So that is the difference between trading journal and trading plan!

That’s right, the trading journal should be part of the trading plan!

Just finished your Skillsfuture course which you conducted online, I learned a lot and this guide is really useful.

You are welcome!

I also finished attending the 2 days Skillsfuture course. I enjoy the hands on session where I can apply what I learnt.

Now trying paper trading.

Reading up on some guides here to prepare for this weekend course!

Thank you for how you make the complicated subject so engaging and easy to understand 🙂

You’re welcome!

Thanks for the very informative blog and you tube videos…

You’re welcome!

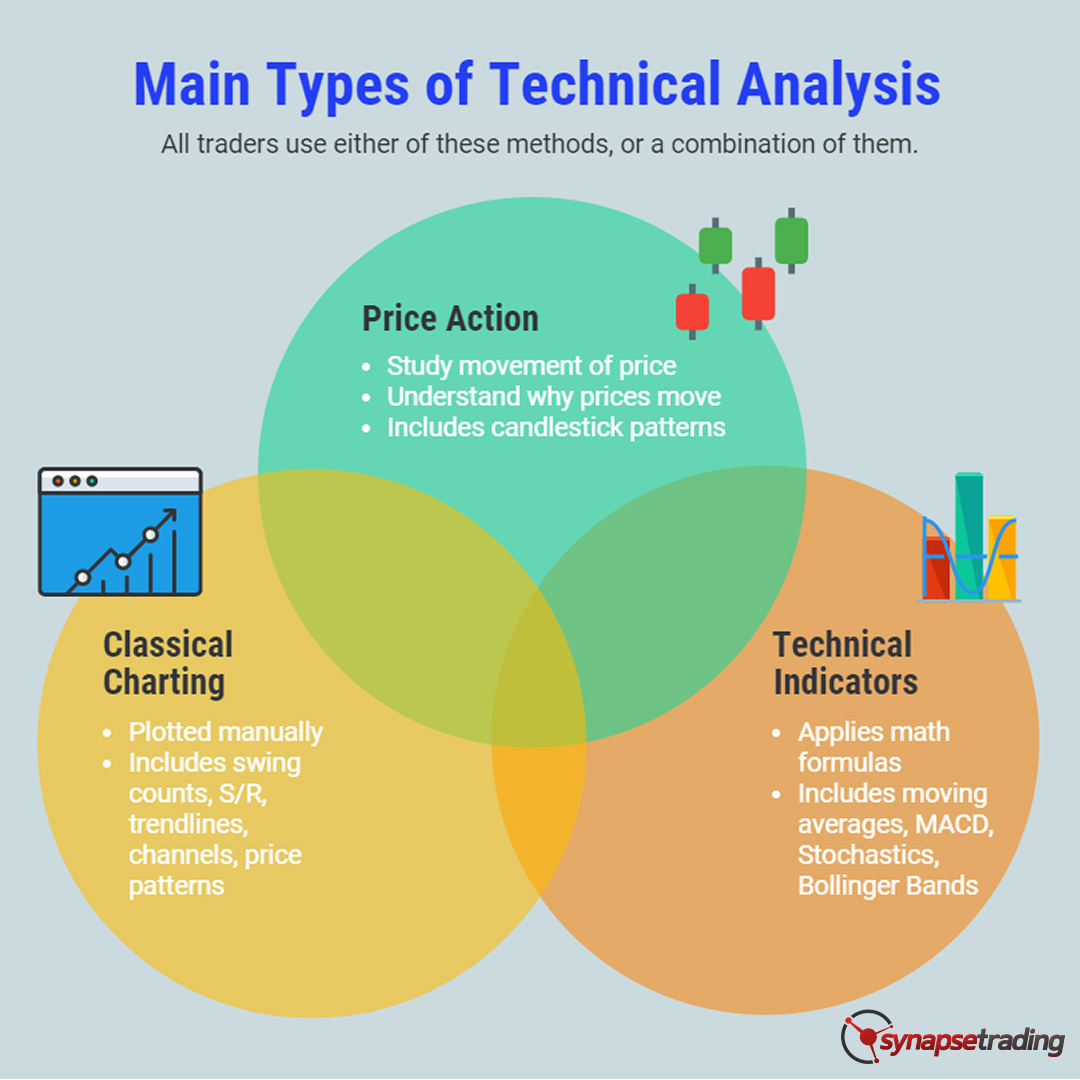

These are the usual technical indicators that I use:

1) RSI- relative strength index, of the signal is over 70 the stock is overbought and due for a dip, under 30 its oversold and due for some green.

2) MACD consists of the signal line and moving average, when the MACD crosses over the signal line, it can be seen as a buy signal, cross under can be seen as a sell signal, it depends on other data from the chart, but for the sake of simplicity, over all crossovers are a buy signal, cross unders are a sell signal.

3) DMI is directional moving index, which I used a lot too.

Now, the real genius of indicators is coupling them to get a bigger picture of price movement; you want to flip back and forth between various periods and look at the indicators, this gives you the bigger picture.

Do you guys use RSI as part of your technical analysis?

I feel that only divergence can be implemented in real time (along with other confluence of indicators).

RSI+MACD is a good mix!

I personally dislike using MACD as it lags price. It’s unreliable to say the least.

I totally agree that MACD and RSI are good match. Also learn MACD, it’s a helpful indicator.

Also, I usually mostly monitor 1D, 4H, 1H for the timeframe.

Thank you for the quality content 🙂 I’ll admit that I’m definitely one of the people who thinks 99.99% of TA is the astrology of finance, but you did inspire me to give it another thought.

TA can be somewhat of a self fulfilling prophecy.

If traders collectively trade based on those same “assumed principles” and algo trading are coded to recognise those patterns, further exasperating the effect, it begins to become true.

For sure there are some stocks that you can time very well using really basic TA tools – MACD, Bollinger Bands, RSI – and hit right consistently >50% of the time. So long as you acknowledge your own biases too.

It doesn’t make it right or wrong. At the end of the day it’s another tool, a tool that I think most would agree at the very least holds some truth. Others just place more value in it

Quite frankly I do use TA quite extensively in my trades. Not entirely but in timing peaks & troughs to squeeze out that extra margin it can be very useful

The problem is if you don’t know anything about TA or how it works, you can’t tell the difference between someone who knows what they’re talking about and someone who does not. When you do know how it works, it’s easy to spot someone using it incorrectly.

Spencer is one of the very few who knows what he is saying. Do read up his free guides!

It’s not a secret that the biggest firms up to CIO level use moving averages and RSI on sectors and the S&P and various industry specific indexes. So to an extent, TA is used at the very highest level of finance. Fund traders use VWAP as a benchmark for their orders.

I believe in fundamental analysis to pick out a good stock for the long haul and technical analysis for the trends and day trading.. large institutions trade off of algorithms, TA becomes almost a self fulfilling prophecy.. people set stop losses at key support zones, sell off during a death cross, buy on the golden cross, etc.

If you want to buy and hold and forget about it, fundamental analysis is the way to go.

I think the basic stuff you get when you look up a chart – SMA/EMA, MACD, RSI – is very useful. You can actually make short term trades based solely on these indicators. It isn’t a subsitute for proper due diligence, and drawing lines all over a chart is nonsense, but indicators are useful, and if you don’t believe me, go look at golden cross stocks, or stocks with RSI under 30, and see what they do over a month.

It identifies opportunities that are currently undervalued, and provides statistical probabilities of something going one way or another. It’s not an exact science, but as long as one weighs reward to risk, and practice proper position sizing, one can win more than lose.

TA isn’t some foolproof system that you’re going to pick up immediately. When they are applied correctly, all it does is suggest which outcomes are more probable, not which outcomes are guaranteed. Sometimes people tend to forget these obvious facts!

For me, technical analysis is the most real form of analysis out there. Instead of looking at it as a chart, look at it as data points. Within a a chart, you can see human psychology at play, whether or not a hedge is propping a price up. There is too much to analyze within a chart and indicators to mention. Fundamental analysis has had very little to do with stock prices for a very long time. There is an obvious glaring reason algorithms use TA to trade, because it simply works!

I actively day trade off TA and although it isn’t full proof it does provide a statistical advantage when and where to enter a trade. The reason most day traders fail is because of poor risk management. My philosophy is that you should trade off technical analysis and invest on fundamental analysis.

There are many good day traders & swing traders who make consistent profits based on TA analysis.

TA absolutely does work, you just need to learn how to use them and just understand that it’s not always perfect.

As long as it works “most” of the time, you will make consistent profits.

Hi everyone! I’m excited to be here and learn from you all. I’m planning to trade in the stock market, specifically in the tech sector. I’m really interested in companies like Apple, Microsoft, and Amazon. What about you all?

Hey! I’m also planning to trade in the stock market but my focus is more on the healthcare sector. I’m interested in pharmaceutical companies like Pfizer, Johnson & Johnson, and Moderna.

I’m also interested in the healthcare sector, but more on the biotech side of things. Companies like Biogen, Amgen, and Gilead Sciences are on my radar.

Forex is a great market to trade in. I’ve been trading in the commodity market for a while now, specifically gold and silver. They can be volatile at times, but there’s definitely money to be made there.

Interesting! I’m planning to trade in the forex market. I’m still doing my research, but I think I might focus on the EUR/USD currency pair.

Cryptocurrency is definitely an exciting market to trade in. I’ve been trading in the options market and it’s been a great way to diversify my portfolio. There are so many different strategies you can use, and it can be really profitable if you know what you’re doing.

For me, I’ve heard a lot about trading in the cryptocurrency market, and I’m considering it as an option. Bitcoin and Ethereum seem like good choices, but I’m still doing my research.

I think the main issue is too many people prioritize pattern recognition, and then people think that all there is to technical analysis.

Basic technical analysis can be extremely useful for finding great potential buy points for swings and possibly long-term investments (buying dips/reversals at key moving averages). It is also about identifying breadth, trends, price momentum, etc., not just in individual stocks but the overall market as well. Almost everyone should at least be aware of the 20/50/200 moving averages in my opinion.

Hell, basic technical analysis is in a portion of the curriculum for investments classes in several universities in my area. So it should not be dismissed as “astrology” or a “scam”. People should be more open-minded towards different tools to potentially improve their trading and investing.

Once fundamental analysis gives you reason to buy, use technical analysis to hammer in the position. That is entering or closing positions.

Hi Spencer, this is really fantastic content. Great images/diagrams too, to easily quickly show and explain what the content is about. So often any TA content jumps deep into it straight away and they don’t check first what type of trader or investor you are, nor what type or level of TA you need. This is refreshing to see well thought out and organised material. I’m a long time teacher, so I appreciate this clear organisation and layout after seeing so much material, good and bad, over many years. Thanks, Graham

Hey everyone, I’ve been working on my trading plan and I’ve found that one of the biggest challenges is staying disciplined. It’s easy to get caught up in the excitement of the markets and make impulsive trades. How do you all stay disciplined? What problems you guys faced?

I totally agree. Another challenge I’ve faced is determining my risk tolerance. It’s important to be realistic and not take on too much risk, but at the same time, you want to make sure you’re not leaving potential profits on the table.

Definitely. Another challenge for me is managing my emotions. Fear and greed can easily cloud my judgment and lead to poor decision-making. I’m still working on finding ways to stay calm and rational when things get stressful.

Emotions can definitely be a challenge. I’ve found that having a solid risk management plan in place has helped me avoid making emotional decisions. Knowing when to cut losses and take profits is key.

I struggle with analysis paralysis. I spend so much time analyzing the markets and trying to find the perfect trade that I end up missing out on opportunities. It’s a balancing act between doing enough research and taking action.

I can relate to that. For me, a big challenge is maintaining consistency. It’s important to have a set of rules and stick to them, but it can be tempting to deviate from them when things aren’t going as planned.

Another challenge is dealing with unexpected events that can disrupt the markets. For example, news events or economic data releases can cause volatility and make it difficult to stick to your plan.

Agreed. It’s also important to have a backup plan in case your original plan doesn’t work out. Having multiple strategies and being able to adapt to changing market conditions is key.

One challenge I face is dealing with the pressure to make money. It’s easy to get caught up in the idea of making big profits, but that can lead to taking on too much risk and making poor decisions.

That’s a great point. It’s important to have realistic expectations and not get too caught up in the short-term. Trading is a long-term game, and it’s better to focus on consistency and risk management.

Another challenge for me is staying organized. With so many different markets and strategies to keep track of, it can be easy to lose sight of the bigger picture. I’ve found that keeping a trading journal and regularly reviewing my progress has helped me stay on track.

I struggle with patience. Sometimes it can be tempting to make trades just for the sake of being in the market. It’s important to remember that not every day will have a perfect opportunity, and it’s okay to sit on the sidelines and wait for the right moment.

I also recommend focusing on risk management. It’s essential to determine the risk-to-reward ratio for every trade, which will help you minimize your losses and increase your profits. As a beginner, I would recommend using a stop-loss order to limit your risk.

Fundamental analysis can provide valuable insights into the financial health of a company, which can impact the stock price. Additionally, I suggest keeping a close eye on news and events that can influence the market.

One technique that has worked for me is the use of trading algorithms. I program my trading strategies into an algorithm, which can help me automate my trades and take emotions out of the equation.

I agree, trading algorithms can be very useful. However, I also believe that having a trading plan is crucial. It helps me stay focused and disciplined, and ensures that I’m not making impulsive trades based on emotions.

As a beginner, I would recommend starting with the basics of technical analysis. This includes chart patterns, support and resistance levels, and indicators such as moving averages and relative strength index (RSI). What indicators do everyone here use?

Understanding chart patterns and support and resistance levels are essential in predicting the direction of price movements. In addition to that, I recommend taking Trading Mastery Program. It covers reading and analyzing price movements.

One strategy that has worked well for me is momentum trading. It involves buying stocks that have shown significant increases in price and selling them when they reach their peak. It can be risky, but with proper risk management, it can be a profitable strategy.

I recommend using a combination of technical and fundamental analysis. Technical analysis helps to identify market trends, while fundamental analysis looks at the underlying financials of the company. By combining these two methods, you can get a more accurate understanding of the market and make informed decisions.

Another technique I like to use is trend following. By identifying the current trend in the market, I can enter trades in the direction of that trend, which can increase my chances of success.