Up Gap Side-by-Side White Lines & Down Gap Side-by-Side White Lines

Market Analysis

Bullish Three Line Break & Bearish Three Line Break

Market AnalysisMat Hold Pattern

Market Analysis1. Market Analysis

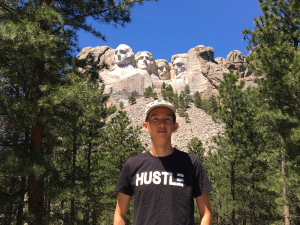

2. Travel Adventures

Nothing Found

Sorry, no posts matched your criteria

3. News & Events

Live Market Workshop: Results Review & New Trading Opportunities

Our monthly hands-on workshop session on stocks and forex was less packed last night, as both new and old traders gathered to discussion our latest hits & misses in the market, and to find new trading opportunities. For those who missed it, we have posted all the best trades discussed in the Synapse Network forum. […]

Sharing Session at SMU | Trading Skills for the Future

Today, I was invited back to the Singapore Management University by the SMU Investment Club, for a sharing session on my trading methodologies, and tips for a future career in trading. I also did a market outlook on the STI and several indices and forex pairs, and we also had some time to go through […]

Guest Speaker at CIMB Securities Event

Click this link to register: https://cimb8feb2014.eventbrite.sg Spencer LiAfter trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Full House Event at Kim Eng Securities! More to Come!

Last night was our first major event at Kim Eng Securities, and I was astonished that it was fully over-subscribed just 2 hours after registration opened! Thanks for all the support! As promised during the workshop, I have uploaded a picture of the “market highlights” below, which includes some trade ideas for tomorrow . Do […]

Would you like to receive timely Facebook Alerts?

Would you like to join the largest facebook fanpage on trading in Singapore (with over 12,000 fans!) and receive useful & timely alerts on a daily basis? Yes, it is totally free, and it will only take a few seconds of your time. How to Receive Timely Facebook Alerts 1. Click here to go to […]

Free Seminar at Maybank Kim Eng Securities – All are Invited for this Special Event!

Next week, I will be giving a free seminar at Kim Eng Securities, and I will be sharing more about my unique method of behavioral analysis to time the markets. The title of the talk is “Behavioral Analysis: Reading the Mind of the Market”. I will share how anyone can time any market simply by […]