Latest Blog Posts

Monthly Market Wrap (January 2026)

Market Analysis

January 2026 will be recorded in financial history as a month of profound regime change, a period where the tectonic plates of geopolitics, monetary policy, and market structure shifted simultaneously, generating extreme volatility and forcing…

Monthly Market Wrap (December 2025)

Market Analysis

December 2025 marked the conclusion of a tumultuous yet resilient year for global financial markets, characterized by a complex interplay of monetary easing, geopolitical escalation, and the persistent dominance of the artificial intelligence…

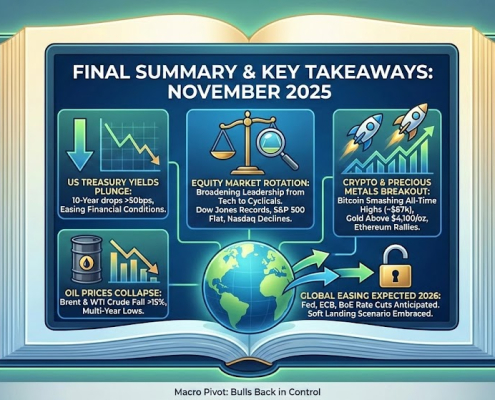

Monthly Market Wrap (November 2025)

Market Analysis

Macroeconomic Indicators and Central Bank Policy

The U.S. Federal Reserve entered November on pause but firmly tilted toward easing. With key data releases disrupted by a federal funding shutdown (the longest in history at 43 days), Fed officials…

Monthly Market Wrap (September 2025)

Market Analysis

Global Stock Market Trends

U.S. equity markets bucked the usual September weakness, posting strong gains and even notching new records. The S&P 500 surged around 3.5% for the month, the Nasdaq Composite jumped roughly 5.6%, and the small-cap…

Monthly Market Wrap (August 2025)

Market Analysis

Global Stock Market Trends

August 2025 extended the equity rally, with U.S. stocks posting a fourth consecutive monthly gain. The S&P 500 rose roughly 2.2% for the month, reaching new all-time highs by late August. The Nasdaq…

Monthly Market Wrap (July 2025)

Market Analysis

Global Stock Market Trends

July 2025 was broadly positive for equity markets. In the US, the S&P 500 and Nasdaq Composite notched their third consecutive month of gains, hitting multiple record highs during the month. The S&P 500…

Monthly Market Wrap (June 2025)

Market Analysis

Macroeconomic Indicators and Central Bank Policy

The U.S. Federal Reserve held its benchmark interest rate steady at 4.25% to 4.50% during the June 2025 FOMC meeting, the fourth consecutive pause. However, the Fed’s latest projections signaled…

Monthly Market Wrap (May 2025)

Market Analysis

Macroeconomic Data and Central Bank Signals

Inflation data showed divergent trends across the globe. In the UK, inflation unexpectedly surged to 3.5% year-on-year in April, a significant jump from March’s 2.6% and the highest level since…

A Deeper Look at the US-China Trade War & Possible Solutions

Market Analysis

The US–China trade war is often portrayed as a clash over tariffs or manufacturing jobs. But beneath the surface lies something far more intricate — a multidimensional struggle that spans economics, psychology, sociology, philosophy, history,…