Best Tools & Resources for Your Trading & Investing

In this short guide, we will compile a list of:

- Glossary of trading terms

- Best trading & investing books to read

- Brokerages which I am using

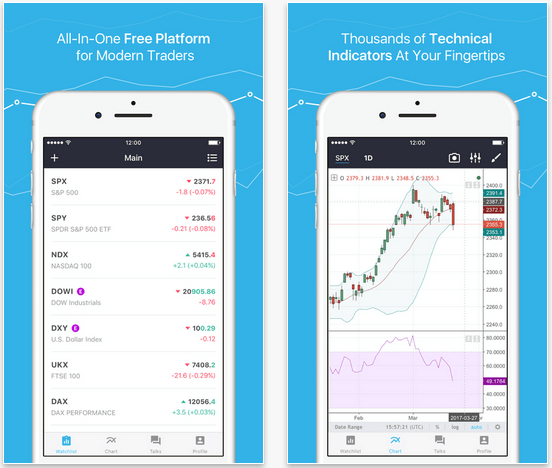

- Recommended charting software

- Other useful analytical tools

More stuff will be added over time!