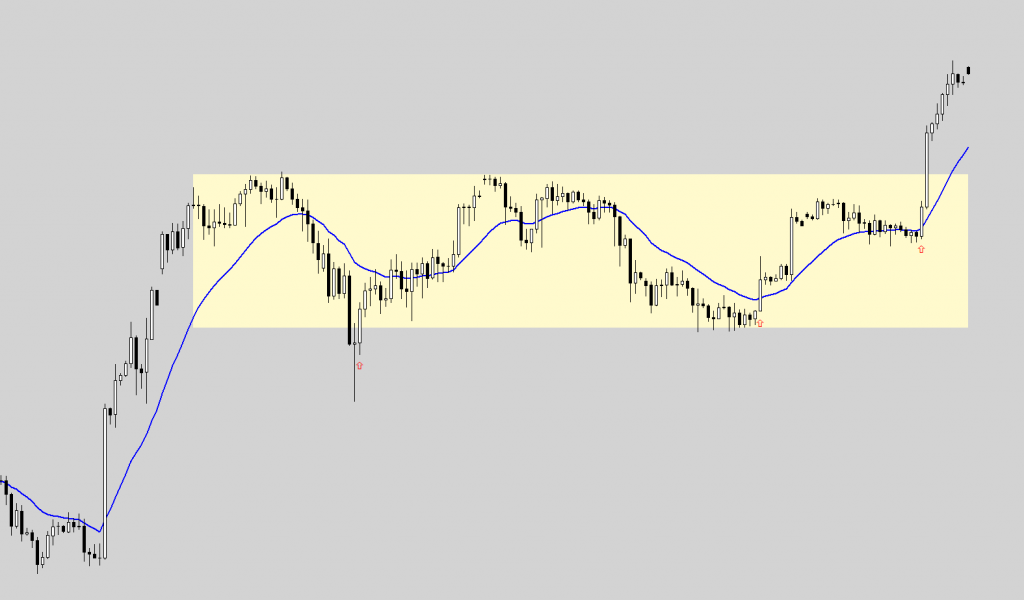

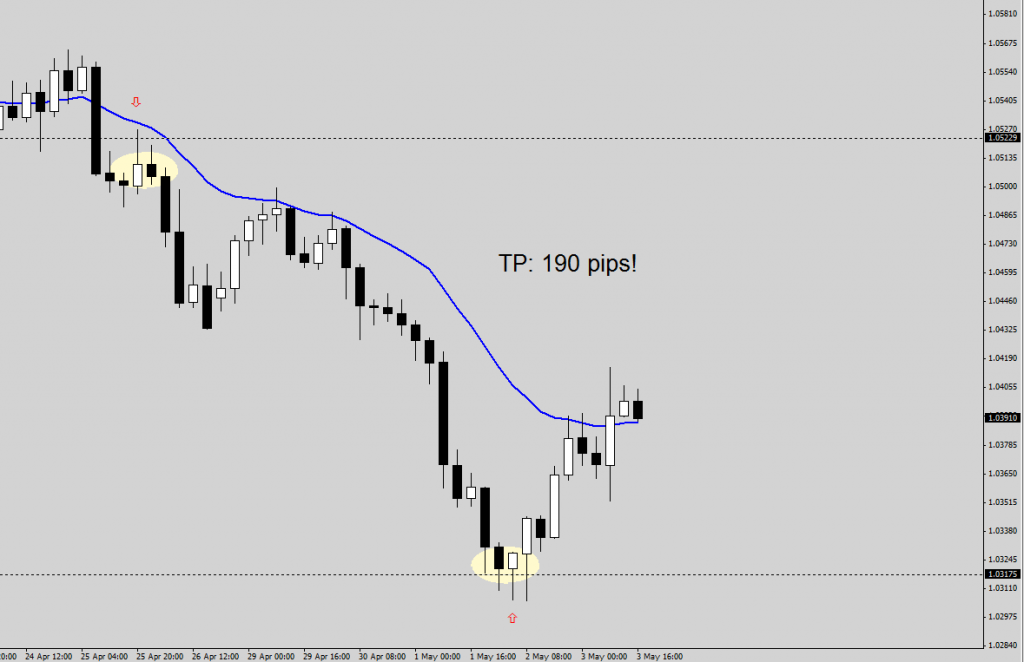

Just a week back, we were studying the naked charts of the STI, and waiting for the perfect time to enter the market. I made my decisions after studying the behavior of the charts, and shared this calls in several forums.

Every day, as we practice more, our skills gets sharper and sharper, and once again this is another of our small victories for pin-point accuracy in our market timing.

Currently, we are holding onto our long positions in DBS and OCBC, which we posted here a while back. https://synapsetrading.com/banking-stocks-bought-dbs-ocbc/

While this might seem impossible to many, this technique actually took me many years of study to develop, and if you are keen to decipher this mystery and see for yourself how this is done, you can join us tonight for a free informal sharing session. http://www.eventbrite.sg/event/7201996365

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.